The words “IRS Audit” strike fear into the hearts of many taxpayers. There is no limit on how many times a taxpayer can be audited by the IRS. If your practice’s business return gets audited, it is a strong possibility that the IRS could issue an audit notice for your personal return.

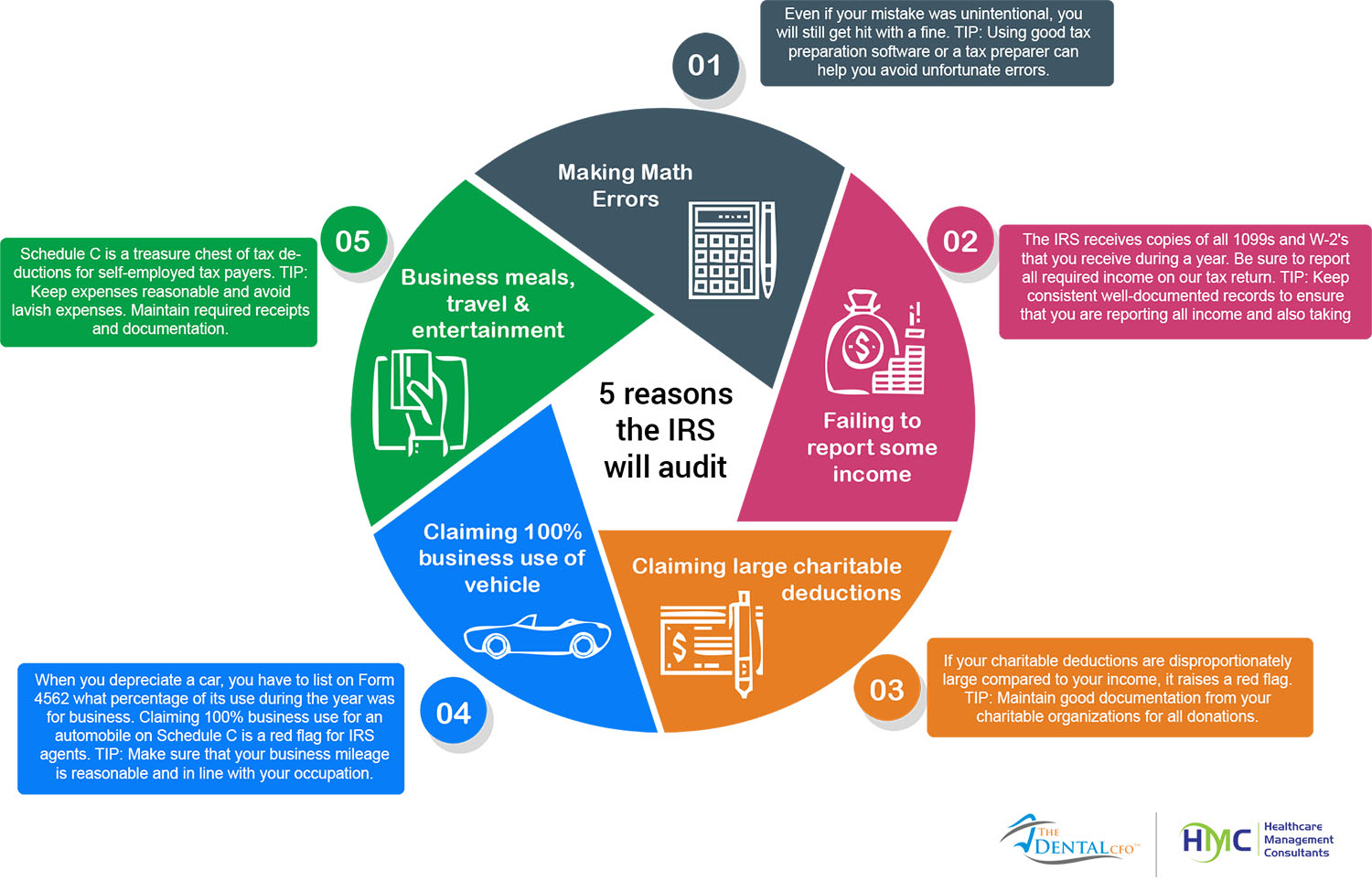

Sometimes an audit is triggered merely due to simple mistakes made by taxpayers which can be easily corrected without severe penalties. This month’s newsletter shares five reasons that could trigger an IRS audit for you or your practice. We hope that you find this information helpful, and please let our team know if we can assist you in any way.

Tina English

Practice Manager / Matthews Internal Medicine